Last week, as turkey leftovers filled the fridge and holiday decorations filled the mantlepiece, kids and teens began filling notepads both analog and digital with hints, links, and downright demands of what they hope to see under the tree.

Following two years of stuff overload, retailers are actually admitting that consumers are less interested in objects in 2022 than they have been in some time. So this year, rather than give a gift that will be forgotten by February, give a gift that will keep on giving. No, we’re not talking about about one of those grow-your-own mushroom kits. We’re talking about gifts that make an impact. Gifts that inspire! This holiday season, give your child a gift that empowers them over the long term.

The Gift of Customers

Cost: $10-40

What’s the one thing every aspiring young entrepreneur desperately needs? Customers, of course! Few things project more confidence in a teen’s venture than a stack of fresh business cards. Order online for contact-free delivery, or purchase a stack from your local office supply store. It’s the gift that says, “this idea has legs.”

The Gift of a Future Language

Cost: $0-99

What if you could teach your child to speak, write, and read a language that would empower them to communicate in the future? Such is the magic of coding. Already the language of tech, many companies have already declared that competence in coding will soon be as essential as proficiency in basic office programs. A few kid-friendly toys and programs can give your child a background in coding, even before they can read or write. Here are a few of our favorites:

The Ozobot Robot ($49)

Ozobot is a personal robot designed to take instructions from kids via black, green, and red lines drawn onto paper. The drawing teaches kids the basics of coding, then rewards them with a robot show choreographed by them.

Kids First Coding & Robotics ($129)

Move a mouse through a maze and send a soccer ball into the goal through story-based learning fueled by kids’ code. But here’s what we really love: no software or phones are required.

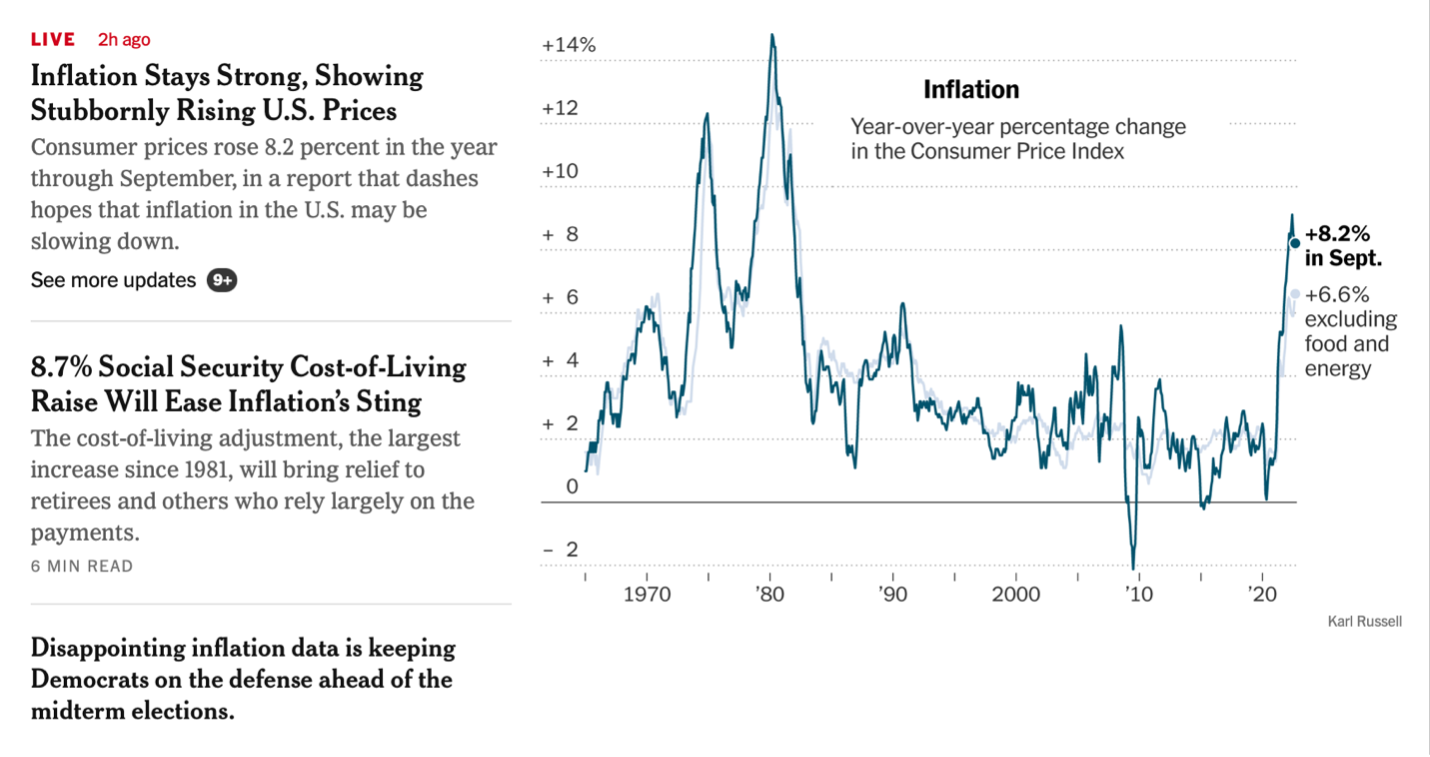

The Gift of an Egg — a Nest Egg

Cost: $20.00+

What if you could give your child a gift today that would benefit them for years or even decades to come. There are a number of ways to do this. Savings bonds, given by practical grandparents for generations, still exist. And now, they can be ordered online. TreasuryDirect.gov is the government’s official site for all things savings bonds. They’ll even help you print a gift certificate to announce your gift! Looking for a more modern, risky, and potentially lucrative option? Consider the gift of stock. Stockpile is an ingenious site that lets givers purchase stock in small amounts (even $20) and give it away. With thousands of companies at your fingertips, a gift of stock can be both practical and thoughtful.

The Gift of Inspiration

Cost: $25.99

Sometimes, your child just needs a spark; a nudge via a dose of inspiration. Show your kids what’s possible by introducing them to the successes of real young entrepreneurs. Our Emmy Award-winning show is available for streaming and download on Vimeo. Purchase access to our entire sixth season plus three “Best of Biz Kid$” bundles for just $25.99! Your kids will be educated, inspired, and–who knows–maybe even motivated to start a business of their own. Want to add a stocking stuffer to that gift? Supplement their season pass with products from entrepreneurs featured on the show including Man Cans candles, Sporting Sails, and Compartes chocolate.

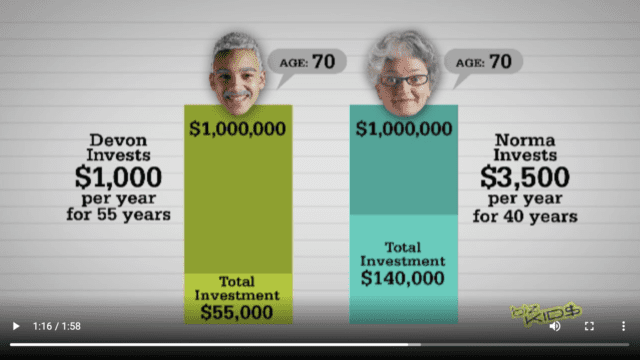

The Gift of a Million Dollars*

Cost: $12.95

*Yes, there’s a catch. But if you believe in the power of education as we do, it’s not too far-fetched. How to Turn $100 into $1,000,000, written by the executive producers of Biz Kid$, is a beautifully designed guide to becoming a millionaire! It’s a comprehensive guide for kids to the basics of earning, saving, spending, and investing money. Written in a humorous but informative voice that engages young readers, it’s the book that every parent who wants to raise financially savvy and unspoiled children should buy for their kids. It is packed with lively illustrations to make difficult concepts easy to understand—all as a way of building financial literacy, good decision-making, and the appreciation of a hard-earned dollar.

How to Turn $100 into $1,000,000 Online Course

We’ve taken the best content from our best-selling book and matched it with interactive actives and inspiring video content from our Emmy Award-winning series. The result? A vibrant and entertaining course for teens called How to Turn $100 into $1,000,000.

Our gift idea? One copy of How to Turn $100 into $1,000,000, one course pass, and one crisp Benjamin. Ready, set, grow…