For a word that makes headlines multiple times per day, “inflation” sure does have a wide variety of definitions.

Merriam-Webster defines inflation this way:

Putting the multi-purpose word’s associations with balloons or arrogance aside, the final definition is downright dense: “A continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services.”

Ask a Joe Schmo on the street to define inflation, and you’re likely to hear something simpler: “prices going up.”

Inflation can be viewed from two angles: the value of a dollar going down, or the average prices of goods and services going up.

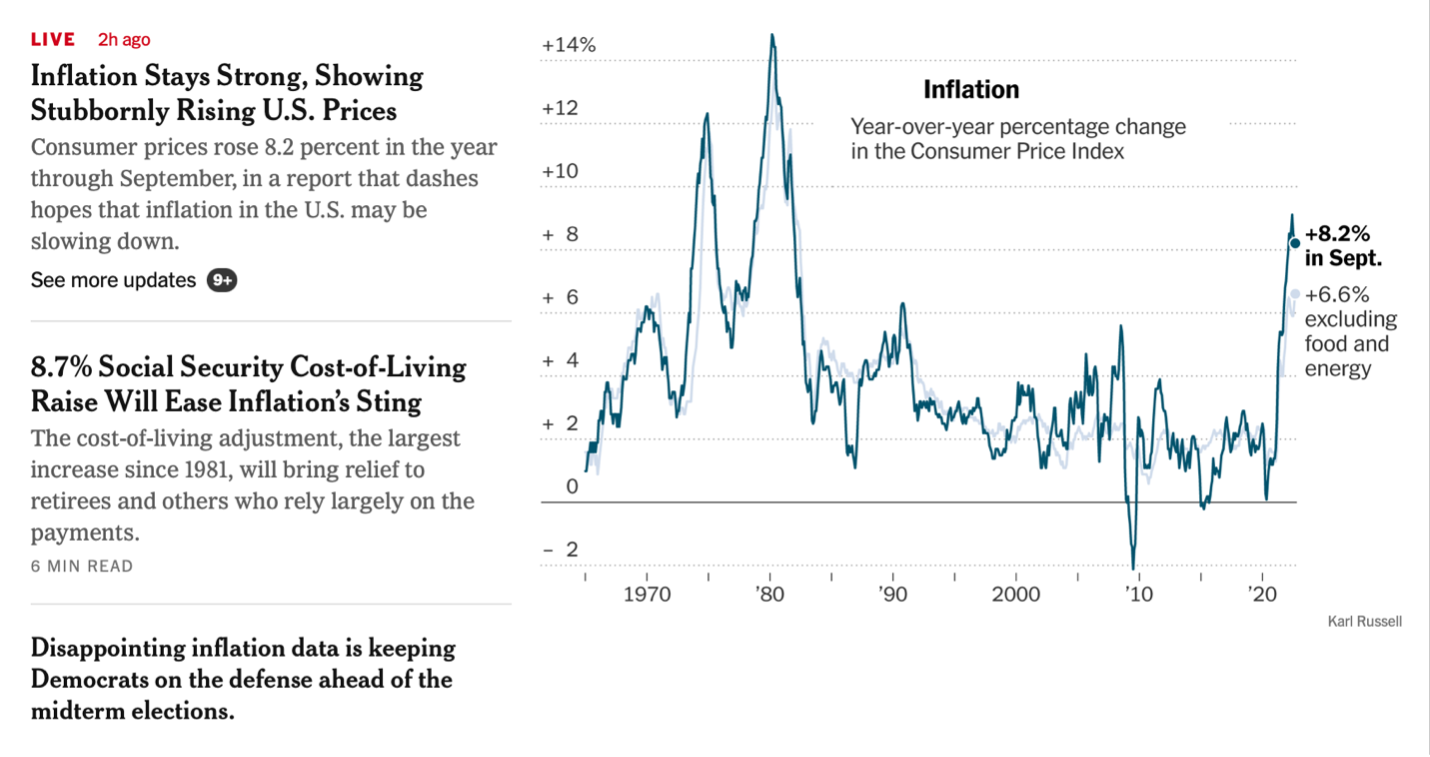

Regardless of how you look at it, the effect is the same: a dollar in your piggy bank is worth less today than it was a year ago. Today, new numbers came out, telling us precisely how much that dollar in your bank decreased in value.

The verdict? 8.2%.

One of the sneakiest parts of inflation is that it can be self-fulfilling. What happens when you read a headline that tells you things are 8.2% more expensive than they were yesterday? If you’re self-employed, you might consider raising your rates. If you’re employed, you might ask for a raise. That collective price increase then leads to more inflation. The cycle is difficult to freeze. That’s why politicians are so hesitant to acknowledge that inflation is happening. They fear that doing so would only make things worse. Their resistance to utter the word is why tweets like these can feel more like fact than fiction:

One bit of reassuring advice came a few months ago from Warren Buffett, who told a savvy young person not to worry – as long as she kept up her craft. Read more about that exchange here.

Another sure bet against inflation? Making your money work for you. Sure, there’s a time and place for playing it safe. Many people who got caught up in crypto mania probably wish they’d stuck to cash. The same goes for people who invested in real estate right before the bubble burst in 2008, or those who “invested” in Beanie Babies before the fad became a garage sale staple. But those who do nothing with their money are guaranteed to have less buying power in the future than they do today.

Our crash course in making money with your money — “How to Turn $100 into $1,000,000” – is available in both book form and as an online course. Today, the book costs less than $12 and ships free with Prime. Amazon’s price tomorrow? It’s anyone’s guess.