7 hours and 22 minutes. That’s the average amount of time the modern teen spends on their phones – not including schoolwork.

The devices we couldn’t imagine until Steve Jobs revealed them to us 2007 are today considered downright essential. Even before COVID-19 turned our phones and computers into classrooms and offices, the devices were taking over our lives — a double-edged sword in every since of the word.

Hundreds of years ago, parents marked their children’s coming of age with the gift of a sword. It marked a level of trust and a level of responsibility. It was a powerful tool, and could become a dangerous weapon. It could be used for good, for ill, and could even be used against you if you weren’t careful.

Sound familiar? The cell phone has replaced the sword with striking similarity. It’s seen by most teens as a rite of passage, and by most parents as a daunting conundrum. It’s a powerful tool in that it puts a world of access into the palm of your hand. And it’s a dangerous one for all the same reasons. But is it anything new? Actually, yes. The figure is double the average from just four years ago.

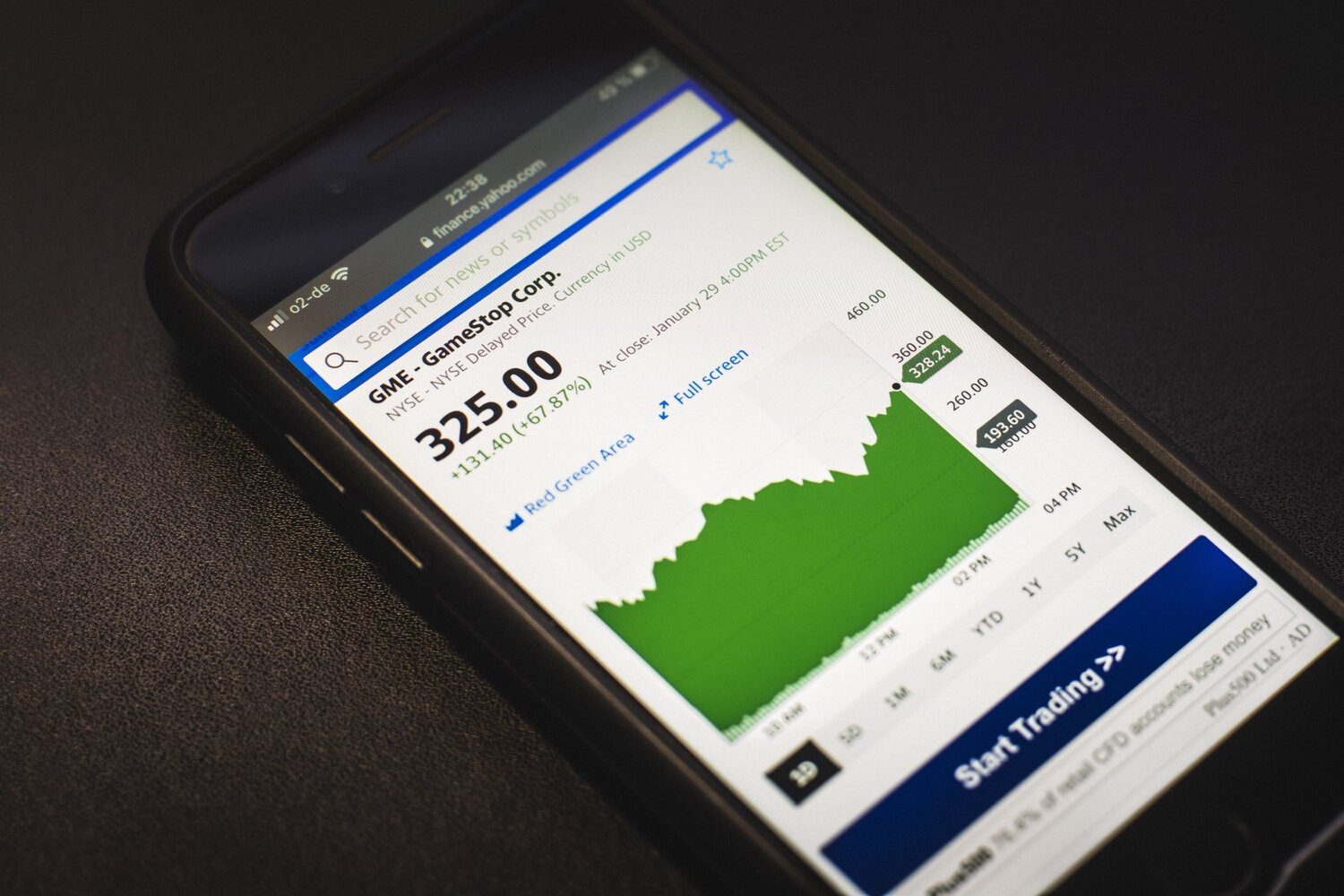

It goes without saying that smartphones have created plenty of good. They’ve connected people across continents, added a $2.4 trillion sector to the global economy, shined light on brutality, created record of moments of jubilation, and allowed professionals to conduct work from the beach.https://www.youtube.com/embed/WIKYgfnYQ0s?feature=youtu.be&wmode=opaque&enablejsapi=1

High School Musical star Cymphonique created a social network where girls can use the power of the phone to get professional help for life’s many challenges.

But what else has our phone-addicted society brought us? Here are a few facts every parent should know:

- 32% of teens say they read for fun between zero and one times per month.

- 47% of teens admit to being “addicted” to their phones.

- Two-thirds of teens say they regularly see hate speech on social platforms.

So what’s a parent to do? Protecting your kids from the downside of devices is a combination of timing, balance, and boundaries.

Timing is Everything

When you got your first cell phone depends on when you grew up. For many parents of teens, it coincided with going off to college; parents of toddlers, the driver’s license. And today’s cell phones? 53% are in the child-sized pockets of kids just 11 years old. The average age at which a teen receives their first cell phone isn’t in the teen years at all: it’s 10.3 years old, according to TechCrunch. Such early adoption comes with new concerns, precautions, and questions.

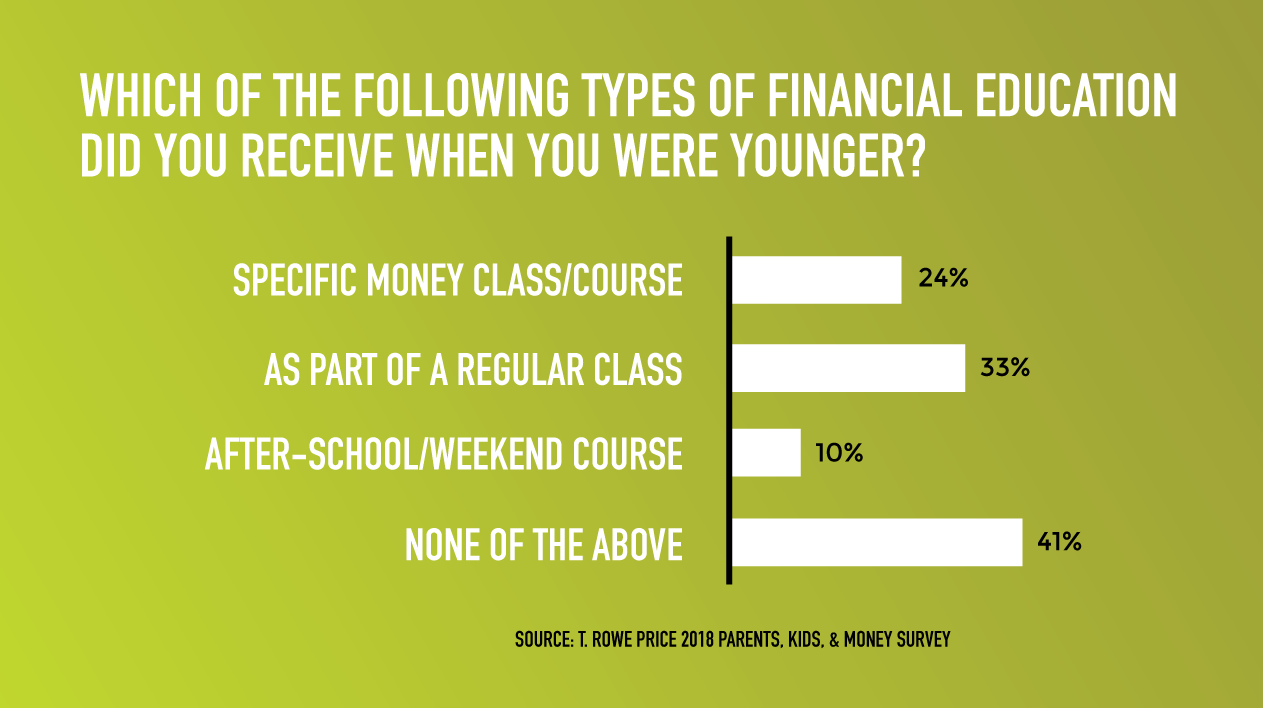

Who Pays?

Just a decade ago, when cell phone adoption was relegated to the teen years, a parent could realistically expect their child to pay or chip in for their cell phone bill. With smartphones expected years before most states allow a child to work at all, the standards are changing.

There’s a silver lining to this shift. As they say, “He who controls the purse strings holds all the power.” As a parent, your authority is already a force in itself. But the power of the purse puts you in more concrete position to enforce rules and monitor behavior. Make it clear that granting the privilege of a cell phone is just that, and misuse will result in rapid disconnect.

That being said, nothing causes a person to value something quite like being financially invested, even if such an investment feels nominal to you. If your 11-year-old earns $5 per week in allowance, perhaps their contribution to a cell phone would require half that.

The Art of Analog Hours

Experts say that healthy cell phone use should be limited to roughly 2 hours per day. If that sounds like a lot, wait until you hear how long Psychology Today found teens are using their cell phones. Ready? 8 hours per day. Psychologists have a word for that: addiction.

But enough of this “when I was your age.” What can a parent do about it? Enact analog hours. Dinnertime? Place all cell phones — mom and dad’s included — into a designated bowl on the kitchen counter. Road tripping? Have designated breaks where phones are kept in the console. And nighttime? That’s deserves a paragraph of its own.

Here’s a rule of thumb: when lights are off, screens are off. If that seems impossible to enforce, there are no fewer than a half-dozen apps created with a single purpose: to help you stop using your phone at night. Parents and teens alike will be better for it.

Drawing the (Phone) Line

As a parent, one of your primary responsibilities is keeping your child safe. On the digital frontier, nothing could be more relevant. Our take on when to draw the line on the phone line? When health or safety is in jeopardy. Included in that list? First up: bullying, either as the instigator or the subject. Next, when used as a tool for breaking your house rules, such as making plans to sneak out at night or invite guests over at off-limits hours. If a phone is putting your teen’s wellbeing in jeopardy, the best thing you can do for them is take it away. Will they see it that way? Not a chance. Do you have the right? You bet your bottom cell phone bill-paying dollar you do.

For more on cell phones and teens, we recommend this article from Psychology Today.