It doesn’t take a grinch to see that this year’s holiday season will be unlike any the world has seen in a century. Amidst a season in which kids (and adults) tend to daydream about creating wish lists, receiving packages, and unwrapping gifts, it’s due time to refresh an old post with new significance. There’s never been a better time to help our kids shift their focus to something they can do to make the world a bit brighter: focus on what they can do for others.

Table of Content

“It’s a flower for you. It says I love you.” My two-year-old handed me a weed pulled from the crack in the sidewalk. I held the gift with reverence, my heart filled to the brim. The lesson was learned, apparently, from a Daniel Tiger episode that explained, “there are many ways to say I love you” before listing “the giving way.” My daughter–a toddler with no income or awareness of money at all–clearly understood the concept of giving. Now on a mission to keep her generosity growing, we’ve learned a few simple ways to start the conversation.

Little Moments of Demonstration

As with all of parenting, children learn more from our actions than our words. As such, the most valuable first step in installing generosity in your child is demonstrating it with actions. Your examples need not be huge. Identify little moments to incorporate into your daily routine. When retrieving a kids meal from the drive-thru, paying for the car behind you won’t just inspire your child; it could set off a chain reaction of giving that makes the days of dozens of people. And that aspiring musician filling the corner with song? Hand your child a dollar or two to toss into their case.

Delegating Your Giving

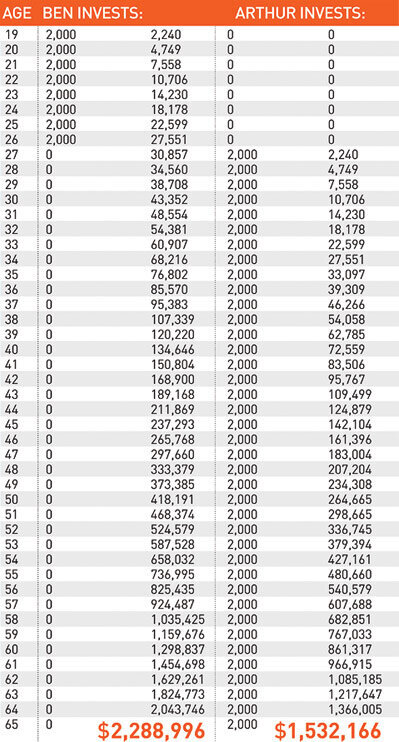

When I was in middle school, my parents received an unexpected check in the mail from a relative. Determined to pay it forward, they set a large portion aside to give away. Motivated to instill the principle of generosity in my sister and me, they brought us into their giving process by delegating some of the giving to us. If I remember correctly, the $100 assigned to each of us was large enough to fund multiple instances of giving. The impact has lasted to this day. The experience allowed us to acquire a taste for giving on someone else’s dime. Whenever possible, include your kids in gestures of generosity. As for the amount? It’s less important than the invaluable opportunity to spark the spirit of giving in your child.

The Spend/Save/Share Guideline

The “spend, save, share” breakdown of childhood income may be a classic, but it hasn’t lost an ounce of effectiveness. If you control the source of income (e.g. allowance), it’s perfectly reasonable to require such a system. For funds received outside of your wallet (like birthday money, lemonade stand profits, etc.), a gentle reminder of the impact a percentage of their cash could make in the life of someone less fortunate may be all the nudge that’s needed.

Talk About Receiving

It may be better to give than receive, but being on the receiving end of giving sure can warm the heart. When your family bears witness to generosity, talk about it with your kids. Perhaps a friend filled your fridge with groceries, or a relative gave you an especially thoughtful gift. Honor the giver with your words, and explain what the gift meant for your family. The conversation will provide a peek into what receiving looks and feels like. Nothing encourages giving like empathy.

We’ve dedicated an entire episode to the topic of generosity, available on our website today: “Can Money Buy Happiness?“