Let’s set aside for a moment the fact that many lottery winners wish they never won in the first place. And the fact that the odds of winning the jackpot – 1 in 292 million – are almost exactly the same odds of a single person being picked at random from the entire population of the United States. And the study that found that 70% of lottery winners had gone broke within 5 years. And the one that found correlation between lotto winning and divorce. And the interviews with the “lucky few” that include quotes like, “I don’t like who I’ve become” and “I wish I’d torn up the ticket.” Okay, all clear?

Sometimes, it’s plain human nature to ignore the odds and risks, and think of the positive side of “what if.”

As a financial literacy brand, our version of “what ifs” looks more like fantasy planning that fantasy purchasing.

So what if YOU were the lucky winner of this month’s record Powerball Jackpot, as one California person is said to be? First, you’d have a decision to make: take a $997.6 million lump sum, or take the full amount ($2.04 billion) over 30 years. The vast majority of people take the lump sum, thinking they’ll be better off investing the sum themselves than taking the annual payments.

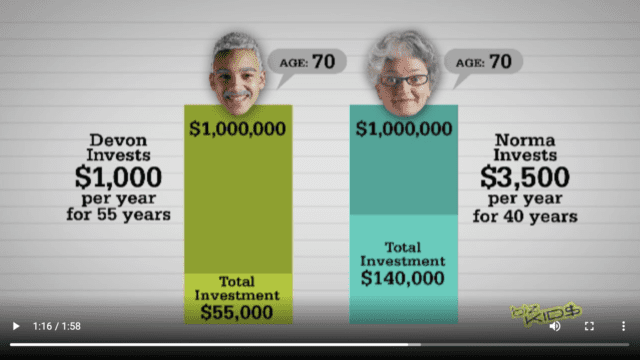

Our take? It all depends on self-control. If you have the self-control to refuse some of your whims, you could indeed do quite well by putting the power of compound interest to work.

But if you are like the 70% of lottery winners who spend every dime within 5 years, perhaps you’d be better off letting the annual checks force you into better habits.

Regardless of Who Wins, Uncle Sam Does, Too

Regardless of if you pick the lump sum or annual payments, your tax bill will likely raise some eyebrows. The federal tax bill on that $997.6 lump sum option? $239.4 million. Good luck fitting all of those digits into the little rectangle on your check! Now before you get too offended by Uncle Sam’s demands, keep in mind where those tax dollars will go:

Seven-time winner Richard Lustig explains his lack of regret this way: “You have to secure your future. The reason why you hear those horror stories about people who win huge amounts like that and all of a sudden they’re filing bankruptcy is because it’s usually from people who have never had that kind of money before in their lives. They just go through it like crazy. They think there’s no tomorrow. Well, there is a tomorrow and eventually it will run out.”

His advice? Make a financial plan with professional help. Ours? Perhaps start with a simple lesson plan: “What to do with a windfall.”