It must have been an interesting week to be a banker. It sure was an interesting weekend to be an account holder at one bank in California.

Table of Content

That’s because last Friday, the federal government announced that Silicon Valley Bank had been closed and taken over by the FDIC. Here’s how the news went down on the business channel CNBC:

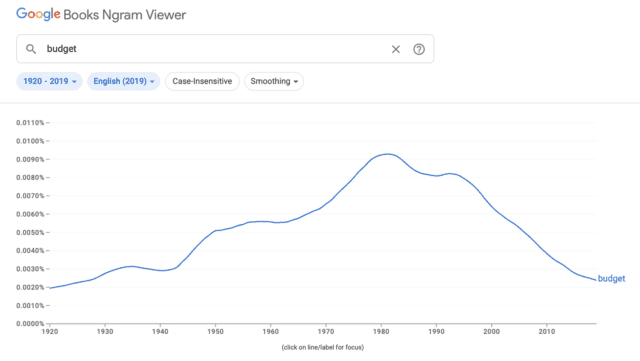

FDIC is short for the Federal Deposit Insurance Corporation, the government agency to which banks pay premiums in exchange for insurance coverage on the money in their accounts. How much, exactly, is the subject of plenty of debate this week. Officially, the amount is $250,000. Before the 2008, that number was $100,000.

Even at 2.5X it’s former level, that $250,000 limit was the cause of some big headaches over the weekend? Why? Even though the national average held in bank accounts is somewhere in the $4000 range, Silicon Valley Bank wasn’t your average bank.

Why was Silicon Valley Bank such a big deal?

SVB (as the cool kids call it) held the funds of many of the country’s most buzzworthy startups. Before the FDIC took over, its website claimed that as many as 50% of the startups backed by venture capitalists (people who write checks to startups in exchange for stock in their company) banked with Silicon Valley Bank. Often, the money those venture capitalists put into their accounts comes in big chunks.

As an example, Roku, the company behind the gizmo that turns your old TV into a streaming one, announced that it had $487 million in a bank account at Silicon Valley Bank. If the FDIC had stuck to its $250,000 max, that would have meant that Roku could have seen $486,750,000 vanish overnight. But the FDIC didn’t stick to its $250,000 limit, an unusual move that got people talking.

What did the government do?

After considering the major damage that the failure of such an unusual bank as SVB could cause, the government’s bank insuring agency announced an unusual decision: it would make all depositors “whole.” By that, it meant that even Roku’s $487,000,000 would be made available to the company. There would be no punishment after all for keeping hundreds of millions of dollars in an uninsured, unguaranteed account. The announcement caused a big debate, but it also raised questions about what it all means moving forward. Here’s how President Biden explained the decision in a quick early morning address:

What does that say about banks as a whole?

One theory floating around is that the FDIC’s decision to ignore its stated limit is a sign that the stated limit will never be enforced again. Another idea is that major changes will be made to that limit once again, just as they were amidst the 2008 recession. But even before such a decision is made, the week’s events offered lessons we can take action from now.

What does this mean for you, Biz Kid?

If you have an account with less than $250,000 in it at an FDIC-insured bank, you’re good. You’ve always been good, and you’re still good. (Keep in mind that guarantee is one of the ways that old fashioned bank accounts differ from trendy things like crypto accounts. As of now, the crypto industry is totally unregulated, so the failure of a platform like FTX would mean you have nothing at all.)

So what if you happen to have more than $250,000? First, you deserve a Biz Kid pat on the back – and a copy of our episode, What to do with a Windfall.) But second, the easiest answer is to make sure you have multiple accounts. For the record, America’s Credit Unions have their own insurance agency, called the NCUA. Deposits of up to $250,000 per account are as good as gold there, too. So if you’re rolling in dough, consider sprinkling your funds between a few banks or credit unions. Then breathe a sigh of relief at your job well done.