June is here, and with it comes the long-awaited summer job! So this week, we thought we would dive into the waters of seasonal employment.

June is here, and with it comes the long-awaited summer job! So this week, we thought we would dive into the waters of seasonal employment.

So what kind of jobs can you get for a summer, anyway? Lifeguards, nannies, and summer camp staff are a few obvious short-term occupations, but there are quite a few others that a determined Biz Kid could land as well. Does anyone in your family own a business? You may be able to land a summer internship working in the office. Can you mow lawns? Clean pools? Take care of pets while your neighbors go on vacation? Think about what needs come up temporarily in the summer and seek to fill those.

Where can a temporary job take you? Even the people who work at the White House had to start somewhere. The White House has released a series of videos chronicling some of the staff’s first jobs. Watch White House Executive Chef Cris Comerford talk about her first job as a salad bar assistant, Senior Presidential Advisor Valerie Jarrett discuss her role as a clinic coordinator at a hospital, and Jimmy Fallon chat about his gum-scraping role at a grocery store.

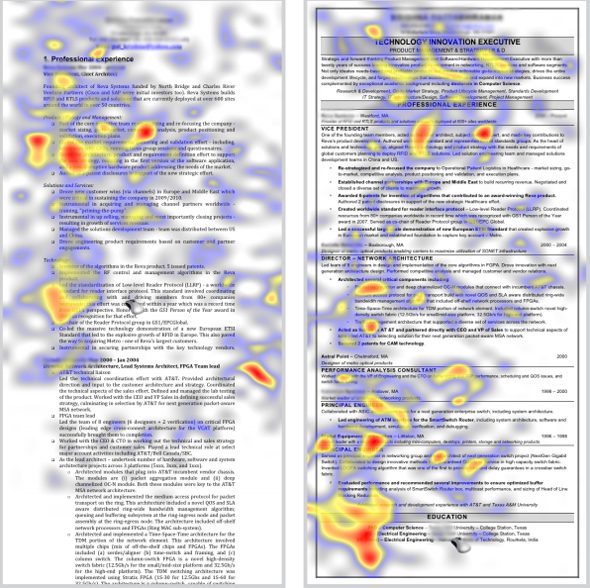

We just released a brand new episode from season 5 titled, “It’s a Job to Get a Job!” Watch clips from it right now on our website, and find out more about resumes, interviews, and internships.

A summer job can be a great way to try your hand at a profession without committing to it for an extended period of time. And who knows? You may just make a connection that will lead you to your dream job in the future.

So tell us: where are you working this summer, Biz Kid?