Table of Content

Moving out: for many teens, it’s the shining light approaching at the end of a laundry-covered tunnel. But if dreams of endless pizza parties, video games, and rule-free reign are prancing in your head, you may find reality downright disappointing. So before you take the plunge to independence, ask yourself five important questions:

-

How will you make money?

It might be a full-time job, a part-time gig, or a business of your own. But knowing where your income will come from is an absolute, nonnegotiable, no-nonsense prerequisite to moving out. But don’t be discouraged; even if you’re not the entrepreneurial type, today’s gig economy is chock full of opportunities to pad your wallet with extra income. From driving for Uber, to selling jewelry on Etsy, there’s no shortage of ways to make extra cash on the side.

-

How much can you save?

If you spend everything you earn, you’ll never make it on your own. Setting a savings plan can be the difference between making ends meet and missing the rent when rainy days come. Make a habit of saving first, instead of spending first, when your paycheck arrives. 10% of your income is a fabulous benchmark. Establish an emergency fund to cover 3-6 months of bills when times are tough, then leave it untouched.

-

What’s your budget?

When mom and dad are no longer underwriting your Doritos and cell phone, living on a budget will quickly become a necessary way of life. Use a software program like Mint or YNAB to track your expenses and spending, or go old school with a simple paper tracker. Whatever method you select, define your spending limits and stick to them. If you still have money left over at the end of the month for those flaming hot Doritos, good for you.

-

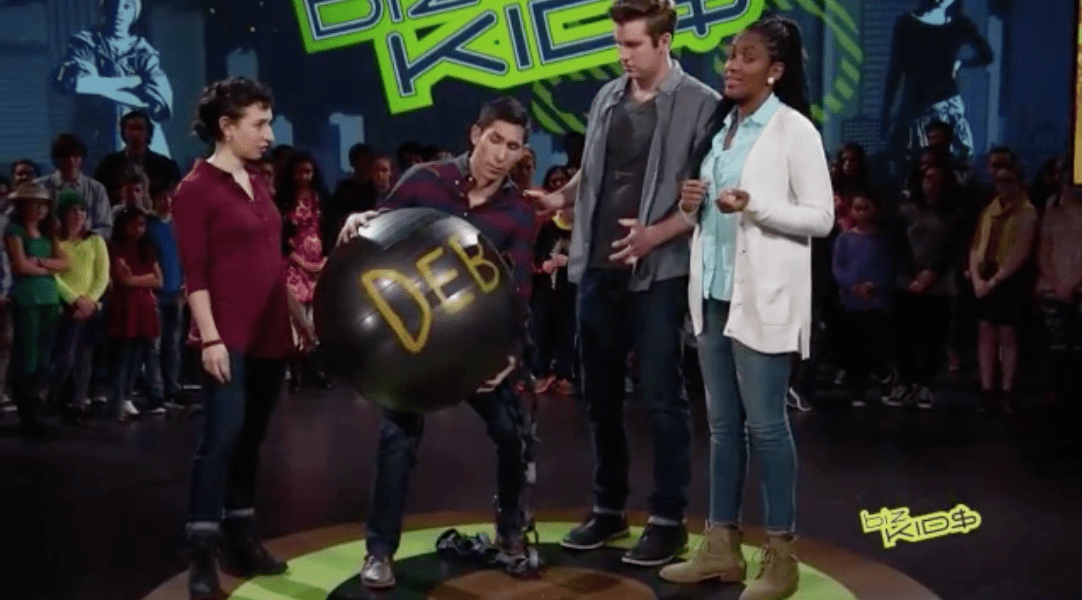

How will you handle credit and debt?

Credit can be both a valuable financial tool and a dangerously alluring trap. Using credit only when absolutely necessary is rule #1 to destroying debt. The brake repair on the car that gets you to work? Important. The dress for your friend’s wedding? Borrow one instead. Also important is knowing your credit score and what affects it. Keeping on top of payments and using less (much, much less) credit than lenders offer are two of the most important factors to keeping your credit in check.

-

Are you thinking about your future?

Retirement may seem like forever away, but the power of compound interest makes thinking about retirement now a must. Research whether a traditional IRA or roth IRA would be most beneficial to your bottom line come tax time, then open an account. Next, do everything in your power to max out your annual contribution limits and let time do it’s magic. Your golden years will thank you.

For more on moving out, check out our episode, Movin’ on Out!