What memories or emotions does the word “budget” bring to your mind? Perhaps it’s a childhood memory about buying clothes – or not buying clothes – for the new school year. Perhaps it’s recent headlines about the government’s inability to agree on a budget at all, and the “nonessential workers” set to be furloughed as the budgets that pay their salaries are frozen in time.

Whatever connotation “budgeting” recalls, one thing is certain: for such a boring word, it sure can wield a lot of power. It turns out that “budgeting” is also susceptible to wild fluctuations in popularity.

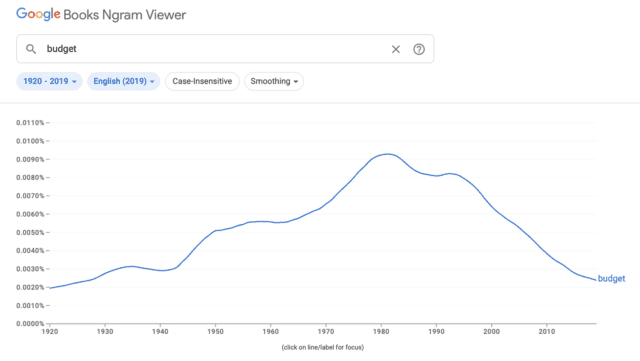

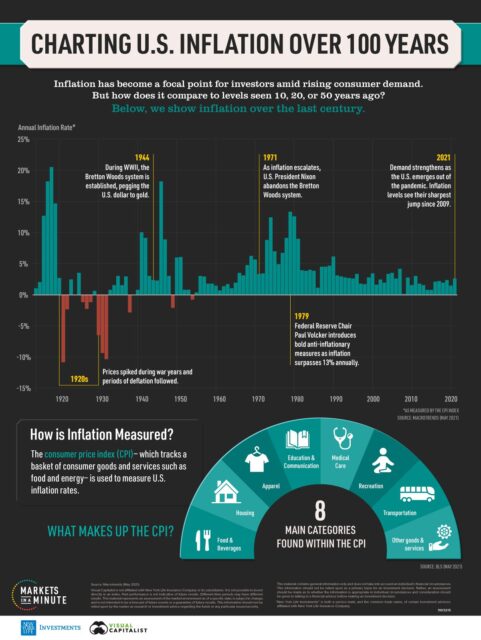

Consulting Google’s database of print word usage, the word’s fallout quickly comes into focus. The phrase has clearly fallen out of vogue as of late, but history paints an interesting picture. Its all-time peak in popularity was the 1970’s – an era that frequently tops the charts in another category: inflation. As costs soared, it appeared that the good old-fashioned budget came into fashion.

As inflation tops newcasts and minds once again, it’s a good time to return to the word – and practice. The good news? Budgeting in today’s app-driven, tech-enabled world is a much easier task than budgeting in those groovy 70’s. Apps like Mint, Dave Ramsey’s EveryDollar, YNAB, and Goodbudget take all of the manual arithmetic out of the practice, tallying debits from your bank account or charges to your credit card and subtracting them from budget categories you’ve established.

Even more good news? The systems you put into practice today could quickly become habits tomorrow. And because those habits pertain to your monthly bottom line, the new habits could prove to be downright lucrative.

Want to learn more? Our Budgeting Basics episode and corresponding lesson plan cover the ins and outs of the topic, including the importance of having a budget, what you learn from keeping track of your expenses, and how to use a budget for personal or business situations.