We’re catching up with one of your favorite Biz Kid$ hosts to hear about his new home, an RV!

We’re catching up with one of your favorite Biz Kid$ hosts to hear about his new home, an RV!

You may remember Eli Weed. Eli was a finalist in our Social Venture competition sponsored by Ernst & Young for his ground-breaking software program designed to help children with Dyslexia learn to type. We awarded him with $500 and mentorship with our friends at EY. We recently heard from Eli, and things are going well!

He’s now a finalist in a social innovation contest in Seattle, Washington. The fast pitch contest he took part in wasn’t just for teens; it was open to adults as well! Here’s a picture of the competition:

Well done, Eli! Biz Kids everywhere, take note!

Read about the Social Innovation fast pitch here.

Learn more about Eli’s venture, Dyslexi-type, here.

It’s happening again. There’s a new iPhone out, and with it, a release of excitement and consumerism throughout the land. It’s amazing how quickly we can go from not knowing something existed to not being able to live without it, isn’t it? Apple is quite skilled at releasing products in such a grand and captivating fashion that the ears of America turn to hear of the new iSomethings. But they’re not alone. Everyday, advertisers are meeting in the boardrooms of Madison Avenue with one thing in mind: how to convince you to spend.

It’s happening again. There’s a new iPhone out, and with it, a release of excitement and consumerism throughout the land. It’s amazing how quickly we can go from not knowing something existed to not being able to live without it, isn’t it? Apple is quite skilled at releasing products in such a grand and captivating fashion that the ears of America turn to hear of the new iSomethings. But they’re not alone. Everyday, advertisers are meeting in the boardrooms of Madison Avenue with one thing in mind: how to convince you to spend.

If you’re a teen, you’re a major target of advertisers. You have more discretionary spending money than you’ve ever had in your life, you’ll soon be able to drive yourself to the store when a moment of consumerism hits, and you care about the way you look. Let’s be clear: you are a target. We’re so sure of it that we have an entire Biz Kid$ episode dedicated to the topic of marketing to teens. (Watch You are the Target here.)

So what does this mean? It means you need to be smart when it comes to taking in advertising. Ask questions before getting out your wallet.

“Do I really need this item?”

“What am I giving up by spending these dollars?”

“Am I being persuaded by advertisers or peer pressure into buying something to make me feel better about myself?”

Have a “sleep on it” policy when it comes to purchases over a certain amount. Perhaps that could be $20. Anytime you are thinking about spending more than $20, wait a day before completing the transaction. You’d be surprised how quickly that shopping buzz can fade.

Finally, educate yourself. Read unbiased reviews of the products you’re considering. Learn about your money personality, and beware of your potential pitfalls.

Budget. Make a plan, and stick to it. It sounds easy, but that new iSofa could be just around the corner. Will you be able to resist?

Watch Biz Kid$ You Are the Target episode here.

Have you heard of Marina Shifrin? Chances are, you have. She’s the woman who quit her job by posting a video on YouTube of her dancing to Kanye West’s hit, “Gone.” The story most have already heard is that she was fed up with being overworked and unappreciated, so after two years of anguish, she produced a video to tell her boss that she was quitting.

Now, we don’t encourage quitting. Nor do we encourage risking your reputation for the sake of a good story. What we do encourage is something about Marina’s story that often went unreported in the stories of her quitting saga. Marina was able to quit because she had a lifestyle of saving that prepared her financially for the unknowns ahead of her. Because of her diligence, she was able to save an entire year’s worth of salary before she posted her now-infamous video on YouTube. An entire year! That’s an entirely different story.

Marina’s video could appear to many as being the epitome of irresponsible. One that could cost her many job opportunities in the future. And that is a conclusion we’ll leave up to you. But her financial life was just the opposite: one of diligence and saving that allowed her to live life on the edge when push came to shove.

So what do you think, Biz Kids? Are you saving for a “rainy day”? Have you ever had a job you hated? Tell us in the comments section below. Read all about Marina’s savings tips here. Learn more about savings from our very own episode, “Saving and Investing for Your Future.”

Silver State Schools Credit Union (SSSCU) helped elementary students learn the importance of saving through its innovative program, “The Piggy Bank Project”. At the end of the school year, students at Walter Bracken Elementary saved just over $40,000. SSSCU received a Biz Kid$ Financial Education Grant from the National Credit Union Foundation (NCUF) to help fund this initiative.

Silver State Schools Credit Union (SSSCU) helped elementary students learn the importance of saving through its innovative program, “The Piggy Bank Project”. At the end of the school year, students at Walter Bracken Elementary saved just over $40,000. SSSCU received a Biz Kid$ Financial Education Grant from the National Credit Union Foundation (NCUF) to help fund this initiative.

The Piggy Bank Project is a collaborative effort between SSSCU, Walter Bracken Elementary School, The United Way of Southern Nevada, Young Philanthropist Society, Junior Achievement, and the Andson Foundation to provide real savings accounts for elementary students, while also providing in class financial education to reinforce the habit of saving money.

Through the use of Biz Kid$ videos in the classroom, students learned the important concepts of needs vs. wants, goals, budgeting, and smart spending.

“At the elementary level, kids learn best and remember videos, far more than any presentation or worksheet,” said Anthony McTaggert, Chief Operating Officer of the Andson Foundation. “The Biz Kid$ videos reinforce the lessons, and give the ever-important piece – media – that helps commit the lesson to memory.”

The project also included an on-campus “piggy bank”, which gave students the chance to put into practice the lessons they learned in the classroom.

“Collaborating in the community to provide financial education to youth through SSSCU’s Piggy Bank Project is a great example of the credit union mission in action,” said Danielle Brown, Director of Development & Donor Relations for NCUF.

A Foundation Grant at Work

This “Grant at Work” is part of a series that highlights NCUF grantees who made a positive impact in their community and empowered consumers to achieve financial freedom through credit unions. NCUF grants are made possible by supporters of the Foundation.

About the National Credit Union Foundation (ncuf.coop):

The National Credit Union Foundation (NCUF) is the charitable arm of the US credit union movement and works as a catalyst to improve people’s financial lives through credit unions. Through NCUF grants and programs, credit unions provide widespread financial education, create greater access to affordable financial services, and empower more consumers to save, build assets, and own homes. Donations to the Foundation enable credit unions to help their members reach life-changing goals and achieve financial freedom.

Empowering students with to be financially literate and entrepreneurial is our passion at Biz Kid$. As such, we are thrilled about a new partnership that is expanding our ability to reach teens by empowering the teachers that will be educating them in the future.

Our friends at Maps Credit Union have partnered with Western Oregon University to equip them with access to Biz Kid$ content, as well as the skills they need to teach financial literacy to their future elementary school students. In the last year, this partnership has already reached 125 teachers, many of whom recently presented their Biz Kid$ lesson plans at a conference for local school districts.

Danielle Brown, Director of Development & Donor Relations for NCUF, said, “Maps’ program is not only impacting current students of WOU, but as these students incorporate Biz Kid$ into their teaching experiences, it will touch countless elementary school students as well.”

We’re encouraged by the work of Maps Credit Union and Western Oregon University, and look forward to hearing about the increased impact Biz Kid$ has in classrooms as a result of this effort.

Read the full press release on this special partnership here.

We’re checking back in with Biz Kid$ host Austin for another installment of “Biz Kid on the Go!”

Today, we’re launching a new blog series called “Where are They Now” in which we track down some of your favorite Biz Kids from years gone by, and hear what’s been going on in their businesses and lives! Today, we’re catching up with Anshul of Elementeo.

Today, we’re launching a new blog series called “Where are They Now” in which we track down some of your favorite Biz Kids from years gone by, and hear what’s been going on in their businesses and lives! Today, we’re catching up with Anshul of Elementeo.

But first, take a look back at Anshul’s Biz Kid$ debut from 2009.

What have you been up to since we last heard from you?

We launched the second version of the Elementeo game (www.elementeo.com). We added a whole bunch of new cards including Gallium Gorilla, Vanadium Viking, Ruthenium Rockstar, and Newton’s 3 Laws. I also thought it would be cool to add blank Do-It-Yourself cards so students could create element characters and personalities of their own. School wise, I graduated from Bellarmine College Preparatory and am now entering my junior year at Stanford University. I am majoring in mathematics.

Is Elementeo still running?

Definitely! It’s always nice to hear kids tell us about their favorite Elementeo cards – we even had a young girl make a Ununquadium Unicorn on our iPhone app. Just a few months back, I got a chance to do a How to Build Your Game workshop with elementary and middle schoolers. It was great teaching Elementeo and walking them through the journey of prototyping and drawing to manufacturing a full board game. The energy and imagination young students bring is great. They just have to get out and start making something new!

What challenges have you faced in your business since we last spoke?

I think marketing has been a challenge. We rely primarily on word of mouth. But games like Elementeo are meant to be played with others, so if someone new plays Elementeo the hope is it inspires them to learn more about chemistry and perhaps check out Elementeo themselves.

Any exciting successes you want to share?

Launching an iPhone app at TEDx San Jose was an incredible experience. We even worked with an animator to get Sodium Dragon to breathe fire which was cool (you can see it in the second half of the talk. In the Elementeo world, Sodium Dragon’s fire is made from dropping some sodium in water. The conference itself was a blast and it was fun writing and presenting a TED talk.

Did being on Biz Kid$ help your business?

It helped kids and parents learn about Elementeo, so definitely! Watching that video brings back a lot of memories, especially all the Elementeo boxes we used to keep in the garage before Amazon came by and took them. Needless to say, there was no space for a car.

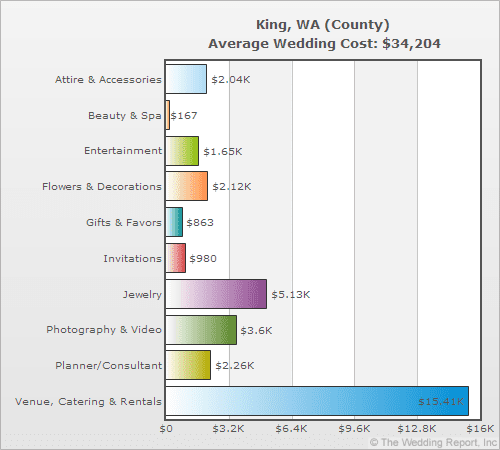

I am getting married in 67 days. I can hardly believe it. After months of planning, budgeting, and purchasing, the day is finally approaching.

Over the past few months of being engaged, my fiancé and I have probably made 37 million billion decisions. (Okay, maybe I’m exaggerating a bit.) What colors should the invitation be? What shape? Which stamp should we use? Where should we have the wedding? What time? How long will set up take? Should we hire a lighting person? Should we have cake? Who should we invite? What song will we dance to? Where will we honeymoon? If I had a dollar for every decision we’ve made, we could probably pay for our wedding!

Of all the decisions we’ve made, (other than the decision to marry each other) one of the most important decisions we’ve made is what our budget would be. Determining our wedding budget has shaped every other decision. It’s amazing how quickly a wedding adds up. For every single individual detail, we’ve bargained, eliminated, and bargained again. And yet, dollar signs continue to prance through my dreams.

Prior to our planning our own wedding, I would have thought that a wedding could only cost a lot if you got extravagant about it. But I’m realizing just how easily it is to spend money even when you have a budget. Thank goodness we do. My fiancé’s parents saved carefully for this day, and I am so very thankful. But the ball is now in our court to make the most of the money we’ve been given for the wedding.

My fiancé and I decided that anything we spend over our agreed upon budget (out of our savings) we will commit to returning to our savings account within the first year of marriage. This way, we filter everything through the lens of, “do I care about this detail enough to have to work to pay for it this year?” This filter has been incredibly helpful in making decisions as things get closer.

And so, in 67 days, when our guests are filling paper cones with confetti, and sitting beneath illuminated trees, we’ll be resting easy, knowing that these little extravagances were purchased with careful thought and consideration of our future.

Large purchases can be intimidating. Whether you’re planning a wedding like me, buying a car, or saving for college, big ticket items can create stress and financial hardship if you’re not careful. Setting a budget, and thinking about the opportunity costs associated with the decision are a great place to start. With some careful planning, and wise thinking, big purchases can be made without breaking the bank. Plus, we’re here to help.

Tell us: how have you made decisions regarding big purchases? Did you succeed? If not, what did you learn from your failure?

For more on making a big purchase, check out our entire episode devoted to the subject.

For budgeting basics, click here for some fabulous Biz Kid$ content.

For every issue, there are people who fuel the problem, others who stand by and do nothing, and finally people who stand up and work to make a change. Morgan Lapp is a member of the third group, and she’s only ten years old.

Morgan is on a personal mission to encourage other kids to live healthy and active lifestyles that simultaneously better their environments. A triathlon runner, Morgan is part athlete, part Biz Kid. She runs her own plant-watering business in her neighborhood, and house sits as well.

“Morgan’s Watering Service” takes care of plants both indoor and out, while homeowners are away. The business is in its third year and is thriving. In busy weeks, Morgan balances as many as six clients at once, riding her bicycle to each and spending 15-30 minutes watering plants at each property. This Biz Kid even takes care of the billing herself!

Morgan is not alone in her ambition; she comes from an equally entrepreneurial family. She was even the inspiration for her family’s meat replacement product, neat. Neat is a soy-free, gluten-free, shelf stable meat replacement product that her family created after Morgan decided to become a vegetarian.

As Morgan puts it, “it’s not meat, it’s neat!”

From running triathlons to watering plants to naming new product lines, we think Morgan is pretty neat, too.

We can all learn from Morgan’s ambition, optimism, and problem-solving attitude. What’s a problem you’ve seen that you’d like to solve? What are you passionate about? Chances are, others have felt the same pains as you, and you could be society’s answer!

Learn more about neat on YouTube here.

Want to start a business of your own? Watch our very own Biz Kid$ episode, “Crash Course on Starting a Business” here.

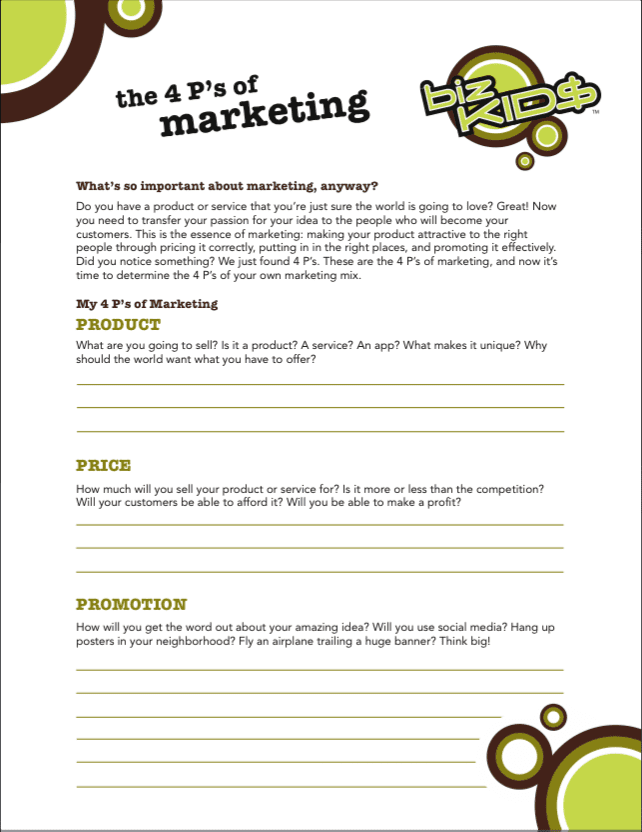

At Biz Kid$, we’re always looking for fresh ways to equip you with the tools you need to build a thriving business. Well, we have an exciting new set of resources for you that we think will do just that! We’ve been hard at work creating a number of guides with rich content ranging from marketing to finance. Here’s a few of the new tools available for FREE on our website:

Table of Content

You’ve made your widget, but now need to take it to market! How much will you charge? Where will you advertise? What’s your promotion plan? With this guide to Price, Place, Product, and Promotion, you’ll have a solid marketing plan in no time.

You’ve made your widget, but now need to take it to market! How much will you charge? Where will you advertise? What’s your promotion plan? With this guide to Price, Place, Product, and Promotion, you’ll have a solid marketing plan in no time.

How can you possibly stand out as a professional when you’re just a kid? We have some helpful tips for making a good first impression, and making a lifelong customer out of a quick interaction.

How can you possibly stand out as a professional when you’re just a kid? We have some helpful tips for making a good first impression, and making a lifelong customer out of a quick interaction.

There’s no sense in starting a business if you’re losing money! This guide equips you with the simple formulas you need to ensure that your bottom line is healthy and lucrative.

We hope these guides empower you to run with your ideas! Let us know what you think in the comments below.

We’re checking back in with Biz Kid$ host Austin for another installment of “Biz Kid on the Go!”