This is part two of a two-part series. For part one, click here.

When I opened my email during the summer before my Junior year of college, I was met with an alarming surprise. The email was from the foundation that had provided me with a life-changing, door-opening $40,000 scholarship. It said that the foundation’s funds were frozen, and that our scholarships would not be paid, effective immediately. This meant that the approaching semester—the payment deadline for which had already passed—would be underfunded. If I didn’t figure out a plan quickly, I would be dropped from my registered classes.

At the time, I was studying abroad in Europe, thanks to the incredible generosity of the same foundation that was now experiencing an unexpected financial crisis. There I was, living a privileged college life, not expecting that everything would fall into question without notice.

I chose my university specifically with the assurance of this additional $40,000 scholarship. Without it, I simply could not afford to pay for my valuable but expensive education. I wasn’t exactly what to do. I Skyped my parents, who were calm but equally uncertain about what to do. Then I called my university financial aid office, thousands of miles away. They agreed to defer payment, to see if the foundation would regain its footing.

Months later, when that extension had also run out, I went into my school’s financial aid office. The financial aid rep listened to my story, then pulled up my transcript. After looking at my grades and standing, she opened up a spreadsheet. Then she nonchalantly said, “You’ve worked hard, and this was out of your control. I’m going to find a scholarship to cover you.”

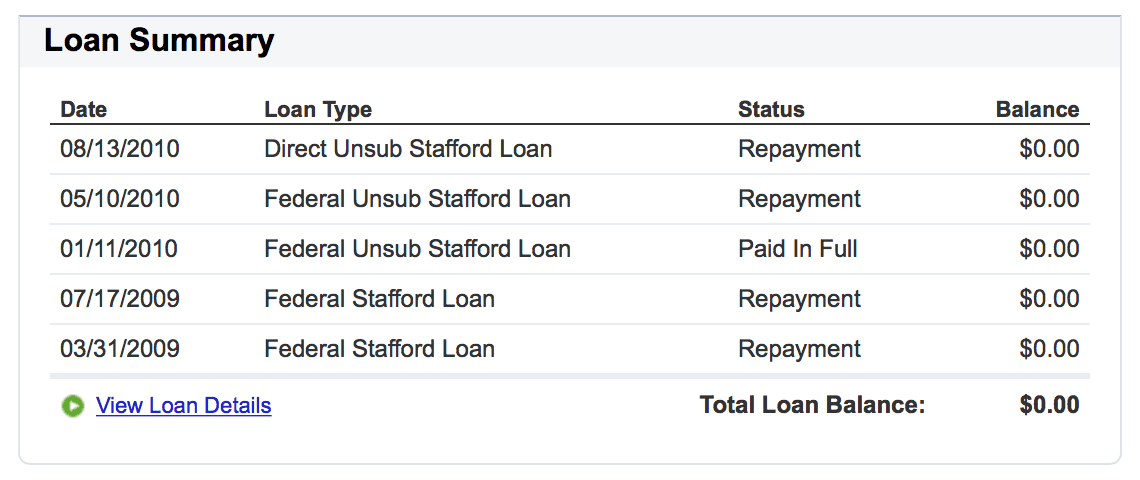

And just like that, the nightmare was over. Dollar for dollar, the scholarship was replaced, added onto the support I was already being given. Flash forward to last month, and I am now a college graduate without a dollar in debt left to pay.

I decided to write about this for a few reasons. First, I had always worried about paying for school. I didn’t know how it was going to work out, and I sometimes wondered if I would leave with a boatload of loans. Instead, I left with an amazing appreciation for the number of factors that worked together to allow my education to happen. From this, I hope to impart just four lessons:

1. Where there’s a will, there’s a way.

I didn’t sit back and hope for the best when I was applying for college. I applied for scholarships constantly, and one of those applications turned out to be worth the time of all of them.

2. Being a young entrepreneur can have ripple effects that you may not foresee.

Being a Biz Kid is amazing training for life, but it can also open doors for scholarships, jobs, and more. I also paid for books and food with money I made from my business during college.

3. Working hard in school will reward you in surprising ways.

When that financial aid representative opened my transcript, a series of poor grades could have made for a very different outcome. My diligence in school was more important that I realized at the time.

4. When life gives you lemons, it’s surprising how many people will help you make lemonade.

Don’t be ashamed when you’re in need. Be honest and ask for help. Chances are, people will be honored to give you a hand up. And when you have a chance to help someone else, do it.

(And speaking of lemonade, here’s at snapshot from my early years of becoming a Biz Kid…)

In the early 2000’s, Enron because synonymous with deception after a grand accounting fraud conspiracy was revealed. And yet Lay, Enron’s leader, saw himself as moral. As ethical.

In the early 2000’s, Enron because synonymous with deception after a grand accounting fraud conspiracy was revealed. And yet Lay, Enron’s leader, saw himself as moral. As ethical.