It was to be Tesla’s biggest event of the year: the announcement of the next iteration of the Tesla brand. This time, a truck. A unique truck. Among its futuristic features? Dent-proof doors and unbreakable glass. To show off the impressive materials, Elon Musk invited a colleague on stage to throw a metal ball at the window. He did. They broke. Here’s how it went down:

Table of Content

In the world of product launches, that’s about as bad as it gets. A key feature, practiced again and again, doesn’t work when revealed before your audience. It was a mistake—a mistake made by one of the most visible entrepreneurs of our time. And one he vowed to learn from.

“Mistakes are a fact of life. It is the response to error that counts.”

– Nikki Giovanni

Hold onto the handrail.

Don’t forget your lunch.

Double-check the time of your appointment.

Wear something more professional.

Finish your assignment.

Parenting can feel like a revolving door of reminders. We love our kids. We want them to succeed. We don’t want to see their knees scraped, their feelings hurt, their grades suffer, or their opportunities squandered. So we hover. We cross their t’s and dot their i’s. We think when they don’t and alert them when they’re unaware. Yet in so doing, we can inadvertently rob them of the most essential opportunities for growth: learning from mistakes. After all…

Who is better prepared to show up early for an interview than the person whose last dream job was lost by showing up 10 minutes late?

Who knows the importance of homework better than the student who suffered the consequences of a missed assignment?

And who will remember their lunch more readily than the one who went hungry after leaving their bag at home?

Mistakes are a sneaky thing. To the moms and dads taking witness, they can seem destructive. Damaging. Moments to avoid at all costs. Yet to the mistake maker, they can prove more valuable than any lesson spoken or wisdom relayed.

Young entrepreneur Carla learned a valuable lesson by making an early mistake: don’t hire your friends.

It goes without saying that teaching is part of parenting and that grace is an essential aspect of love. Alerting our kids to the challenges of life is an essential part of our responsibility; coming to their rescue, an act of selflessness that bonds parent to child. But there’s a line at which compassion becomes something else: enablement.

The Biz Kid$ hosts have a lesson for teens: learn from your mistakes so you don’t make them again.

Bringing a forgotten homework assignment to school for the responsible child can be loving. Retrieving the 17th forgotten homework assignment this year? Enablement.

A study published in Scientific American puts it this way: “learning becomes better if conditions are arranged so that students make errors.”

The same is true in teaching kids about money. The occasional reminder that pricey prom season is approaching can be helpful. But a $200 bailout offered after they’ve squandered their savings? Such a habit will likely continue–and grow–into adulthood as it takes on a familiar name: debt.

Keeping your child from scraping their knees is an admirable reflex centered in love. Yet raising a child who becomes an adult who takes responsibility requires a scraped knee every now and then.

For an additional resource on the topic, download our free lesson plan: “Learning from Mistakes.”

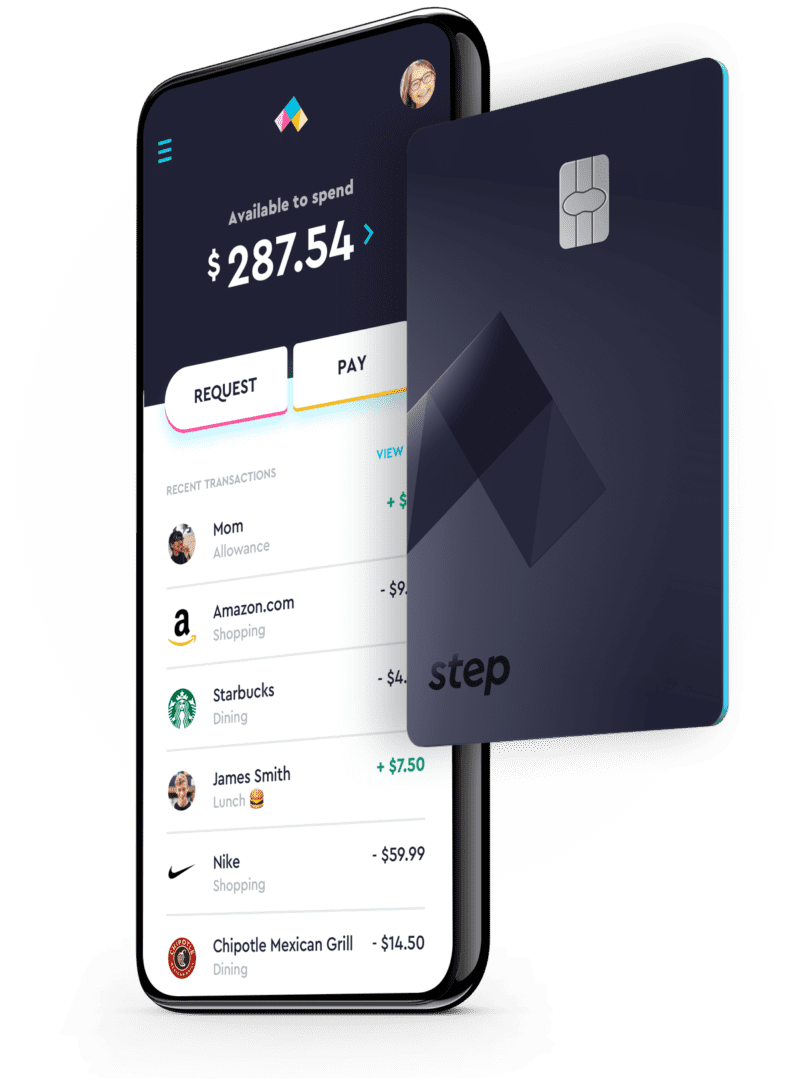

“Schools don’t teach kids about money.” Such is the straightforward problem statement of CJ MacDonald, CEO of a new app that’s secured $22.5 million in funding from a who’s who of celebs and business tycoons. Among the famous names: Will Smith, Nas, Ronnie Lott, and Kevin Gould.

“Schools don’t teach kids about money.” Such is the straightforward problem statement of CJ MacDonald, CEO of a new app that’s secured $22.5 million in funding from a who’s who of celebs and business tycoons. Among the famous names: Will Smith, Nas, Ronnie Lott, and Kevin Gould.