A couple years ago, the difference between stuffing bills into a ceramic pig and driving them to your local bank would have been…forgettable. The interest awarded to savings account holders at some of the country’s biggest banks was 0.01%. No, not 1%. Not 1/10th of 1%. 1/100th of 1%. What would that mean for you? If you scraped together $100 and put it into a big bank’s savings account last year, then held it there until today, you might be rewarded with…wait for it…one cent. Interest rates like those might make you wonder why the banks bother at all.

Table of Content

But times have changed. As inflation has grown hotter, the Federal Reserve has taken steps to try to cool it down. The main tool at their disposal? Raising the interest rates it charges banks. The ripple effect: banks raise the interest rates they’re willing to pay you for those desposits. A few big financial institutions are now offering 3.5% and 4.0% APY (a.k.a interest) on savings. Rates like that are virtually unheard of in risk-free investing. Sure, you may be able to get an average of 7% over time in the stock market, but there are no guarantees. And you may have been lucky to get 2% in a certificate of deposit (a.k.a. non-musical CD) a couple of years ago, but your money would be stuck for a solid year. Today, 3.5% interest is within reach, as are your hard-earned dollars, should you need them in a pinch.

What happened to America’s savings accounts?

Interestingly, all of this is happening just after most Americans could have benefited from it. During the pandemic, Americans went from saving a small fraction of their income to a whopping 33%. A third!

Just how big of a bump did piggy banks get? A record-breaking one. Double the previous record set in 1975. And weighing in at the all-time high since the beginning of record keeping.

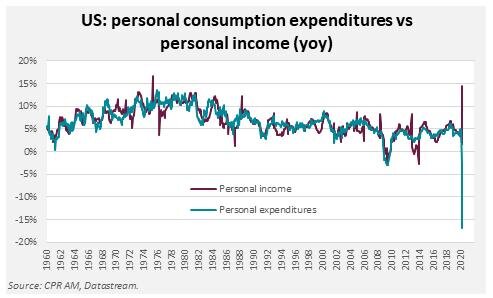

Talk about a savings bonanza! Part of the bump was due to the $1200 stimulus checks sent to millions of bank accounts. Those payments brought a bump to average personal income, which historically would have resulted in a spike in spending. By all appearances, it seems to have done the opposite. Check out this eye-popping chart showing the change in personal income and personal expenditures since 1960:

It turns out that when the future is uncertain, Americans are surprisingly capable of squashing their urges to spend. So what’s the result? It depends on whom you ask.

The Debatable Impact of Saving vs. Spending

Many believe that in the short-term, saving is bad for the economy. Short-term thinkers would much rather see dollars flow into the consumer-driven economy than sit in our bank accounts. They see the trickle-down effects to small businesses, large employers, suppliers, and so on. Their argument? Spend it.

Over the long-term, others say, such savings can prevent further economic distress. If more Americans have emergency savings a.k.a. “Rainy Day Funds,” fewer could fall into default on their mortgages, cars, etc. if times get tougher. Save it for a rainy day, they say.

In the middle of both arguments is yet another position called the “train station.” Even saved funds, they argue, will eventually be spent (“leave the station”), invested into stock or real estate, or given away. Saving, they say, is merely deferring a jolt to the economy. Those who save will likely spend it later – when doing so won’t carry additional risks, such as lacking a safety net.

Teaching Kids to Save

Deferred gratification is one of the major milestones of maturity. As such, saving is a difficult concept for most kids. The more tangible and concrete saving can feel, the more likely a kid is to follow through with it. If your child has their eye on a new $30 video game, for example, but they make $10 per week in their allowance, work with them to create a chart that has a checkbox for $2, $5, and $10 increments. They get to choose how big a box to check each week, and how much progress to make toward their goal. Rather than refusing their indulgence, they get to see the progress they’re making toward it. If only there were a patch for that…

Another way to teach the power of saving? Entertain them. Lucky for you, one of our core “learning pillars” is Saving & Investing. Our trove of video clips and activities make the topic enjoyable to teach and easy to understand. And for just $4.99, you can purchase our new Saving & Investing Bundle, including 7 profiles of real kids who’ve amassed some serious savings.