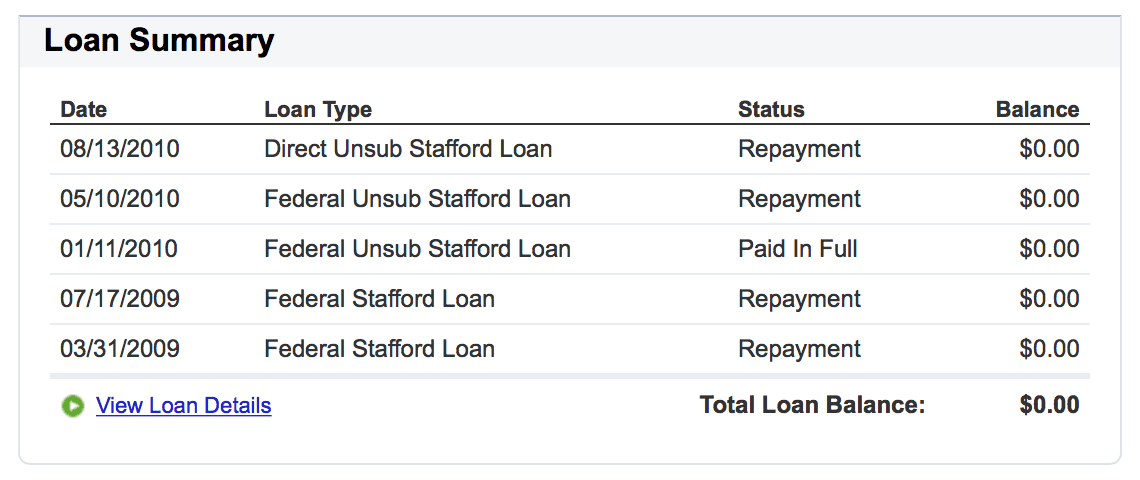

Last week, I did something I’d been trying to accomplish for four years: I paid off my student loans.

For me, this was a milestone not just because I had finished paying off $14,000 in debt. It marked the end of a years-long concern: how in the world would I pay for my education when I was just trying to figure out how to make 100 dollars a day at the time? My story of paying for college is one of major ups and downs. This will be a two-part series, and today I’ll start with the sunny, pre-recession beginning.

When I enrolled at Baylor University in 2007, the cost of tuition was $25,320, plus housing, food, and living expenses. In total, I needed approximately $40,000 per year to survive.

My parents are diligent, incredible people who chose careers with rewards more intrinsic than material. As a result, I always knew that I would have to look outside of the coffers of my parents to find educational funding.

During my senior year of college, I spent many evenings applying for scholarships from all kinds of organizations. Some for $100, some for $100,000. I was running a graphic design business out of my bedroom at the time, and my high school counselor found a scholarship that looked right up my alley. It was to be given to young entrepreneurs, by the personal foundation of a billionaire businessman. I applied.

Just months before I decided to go to Baylor, I came home from school to a FedEx envelope tucked inside the glass front door of our home. It was from the foundation that I had received an interview phone call from the week before. I ripped open the envelope, and inside I read, “You have received a scholarship in the amount of $40,000.” I literally fell to the ground. The scholarship could be used at any university of my choosing, on top of other aid. They would pay $10,000 per year for four years.

When Baylor notified me of their own generous scholarship package, I added up the numbers. Between my need-based aid, scholarships from Baylor for my test scores and GPA, and outside foundation scholarship, I had a full-ride, including living expenses. I would just have to pay for text books. I couldn’t believe it. This thing my family had worried about for years was working out. Fully covered. Done.

I enrolled at Baylor, and showed up in the Fall of 2007 with a car full of clothes, “healthy snacks” (thanks, Mom), and a number of freshly-purchased Target items, like a made-for-college laundry hamper and desk organizer.

Over the next two years, I would study diligently, eat lunch with great friends, and even study abroad in Europe. Everything was looking up. Then in 2008, while I was studying abroad in Europe, I got an email that would change everything.

My neatly organized life was about to get disrupted, but what happened next made me appreciate my education even more.

Check back next week for Part 2 of this series.

Resources:

Search for scholarships at www.fastweb.com

Find the cost of your favorite school here.