“Do you have our store credit card? If you sign up today, you could save an extra 20% off of today’s purchase.” Hmm, twenty percent, you think. That’s $10. I could use an extra $10. You’re about to accept the offer. But wait! Did you read the fine print? Credit card signup offers can seem like incredible paydays. But carry a balance, or make a late payment, and you could quickly watch your debt spiral out of control.

A recent thread on Reddit caught our eye this week. The original poster claimed to be the previous employee of a credit card company that manages the cards for many retail brands. They revealed a shocking statistic:

The average time it takes a customer to pay off a single purchase is six years.

Six. Years. If you’re like me, you probably lose your excitement about an article of clothing at month three or so. Just imagine paying for that sweater when high school sophomores are graduating from college. How is that possible? By only making minimum payments, the interest snowballs. A typical retail card interest rate can be as much as 26%, 29%, or 35%. Talk about crazytown!

The bottom line: be on guard when reviewing credit card signup offers, and only sign up if you’re confident you could pay off the balance in the first month.

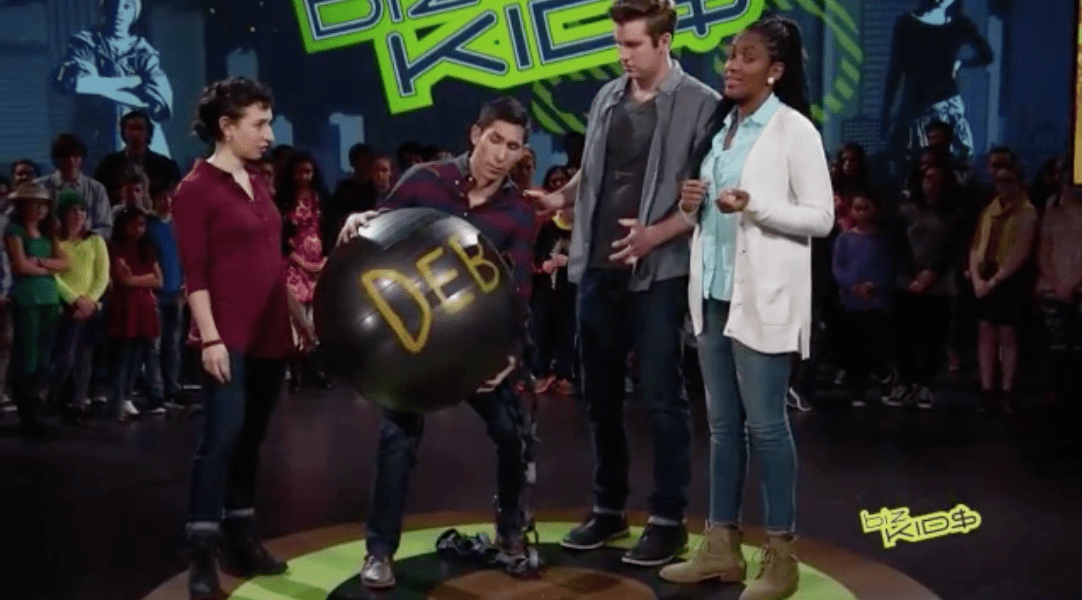

How about you, Biz Kid? Have you ever experienced snowballing debt from a quick decision in a mall or big box store? What do you wish you would have done instead? Tell us in the comments below.

For more about credit cards, check out our new episode, My First Credit Card.