I am getting married in 67 days. I can hardly believe it. After months of planning, budgeting, and purchasing, the day is finally approaching.

Over the past few months of being engaged, my fiancé and I have probably made 37 million billion decisions. (Okay, maybe I’m exaggerating a bit.) What colors should the invitation be? What shape? Which stamp should we use? Where should we have the wedding? What time? How long will set up take? Should we hire a lighting person? Should we have cake? Who should we invite? What song will we dance to? Where will we honeymoon? If I had a dollar for every decision we’ve made, we could probably pay for our wedding!

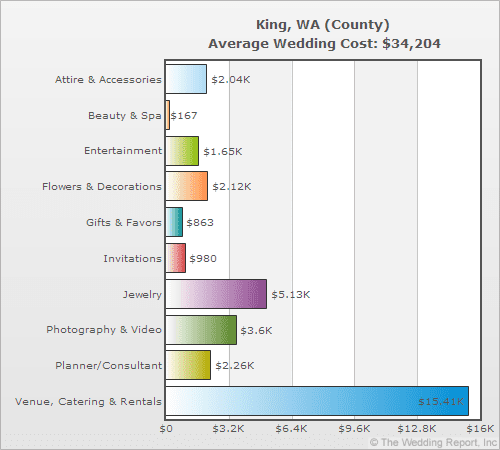

Of all the decisions we’ve made, (other than the decision to marry each other) one of the most important decisions we’ve made is what our budget would be. Determining our wedding budget has shaped every other decision. It’s amazing how quickly a wedding adds up. For every single individual detail, we’ve bargained, eliminated, and bargained again. And yet, dollar signs continue to prance through my dreams.

Prior to our planning our own wedding, I would have thought that a wedding could only cost a lot if you got extravagant about it. But I’m realizing just how easily it is to spend money even when you have a budget. Thank goodness we do. My fiancé’s parents saved carefully for this day, and I am so very thankful. But the ball is now in our court to make the most of the money we’ve been given for the wedding.

My fiancé and I decided that anything we spend over our agreed upon budget (out of our savings) we will commit to returning to our savings account within the first year of marriage. This way, we filter everything through the lens of, “do I care about this detail enough to have to work to pay for it this year?” This filter has been incredibly helpful in making decisions as things get closer.

And so, in 67 days, when our guests are filling paper cones with confetti, and sitting beneath illuminated trees, we’ll be resting easy, knowing that these little extravagances were purchased with careful thought and consideration of our future.

Large purchases can be intimidating. Whether you’re planning a wedding like me, buying a car, or saving for college, big ticket items can create stress and financial hardship if you’re not careful. Setting a budget, and thinking about the opportunity costs associated with the decision are a great place to start. With some careful planning, and wise thinking, big purchases can be made without breaking the bank. Plus, we’re here to help.

Tell us: how have you made decisions regarding big purchases? Did you succeed? If not, what did you learn from your failure?

For more on making a big purchase, check out our entire episode devoted to the subject.

For budgeting basics, click here for some fabulous Biz Kid$ content.