Retirement. For most kids, it’s literally the last thing on their mind. After all, why think of the end of your career when it’s just beginning? The answer comes down to the power of compound interest. A dollar saved today is actually more valuable than a dollar saved tomorrow. How is that possible?

Here’s the gist: a Roth IRA is a retirement account that the government allows to grow over time without taxing the interest. If a 15-year-old were to contribute the maximum amount to their Roth IRA, $5,500 per year, they would have double the amount of a person who started at age 25 and saved until they were 70 years old. That’s crazy! And that’s math, assuming a 7% interest rate.

So what should you do to get started? If you’re under 18, you’ll need to open an account with a grown up. It’s called a custodial account. Next, shop around for a broker that allows low minimum balances. Some offer accounts with as little as $100 in seed money. Next, watch out for fees. Fees could easily eat at your returns if you’re not careful. Our friends at the Wall Street Journal have a great roundup of fees for custodial Roth IRAs.

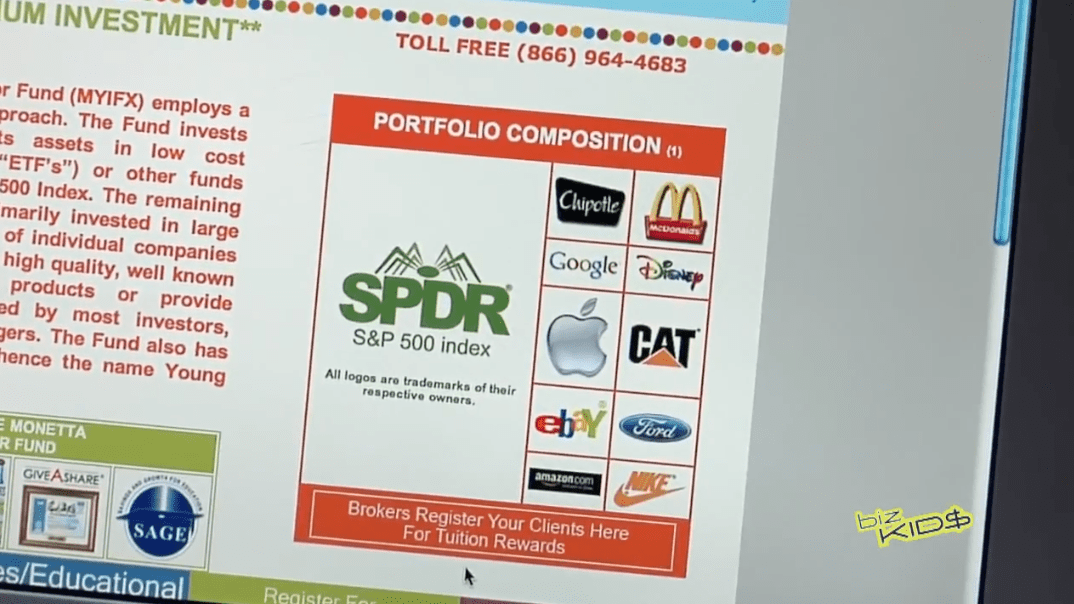

Then, it’s time to pick some investments. Think picking stocks is best left to adults? Sometimes, kids are more aware than anyone else of the coming trends. Take it from the money-savvy kids behind Kids Toys Inc.:

Kids Toys Inc.

Saving for retirement is all about growing your money. For more tips on growing your money, check out our new book, “How to Turn $100 into $1,000,000.”