If you’d listened to the financial “wisdom” of the pundits on social media over the last couple of years, you’d have been in for one heck of a roller coaster ride. If you happened to get lucky with regards to the timing of when you followed their advice, you could have made it rich on meme stocks (remember Game Stop?) or turned pennies into profit through cryptocurrency.

Table of Content

Or, if your timing was slightly different, you could have seen fortunes turn to rubbish with the collapse of FTX, or your rainy day turn to puddles with the drop in those very same meme stocks. The trouble with financial fads is that, for some, they can appear smart. As the old saying goes, “even a broken clock is right twice per day.” Just consider the total load of content put before our eyes each day last year:

95 million Instagram posts.

867 million Tweets.

300 million Facebook photos.

252,000 new websites.

Such was a single day of life in 2022. Information overload is an understatement. With that many pieces of content being written, just like a broken clock, nuggets of luck are sure to count among the counsel. After all, thousands of times per second, new thoughts are published, ideas are broadcast, and tips are shared. Those looking for lasting wisdom amidst the noise do so amidst a hailstorm of information.

In this age of information overload, let’s do something else. Let’s get back to basics.

Old wisdom works.

When Tess Vigeland, the host of NPR’s show Marketplace Money, retired, she signed off by sharing what she’d learned over her years hosting a show dedicated to finance. Her final words of wisdom?

Now here is where I could insert a bunch of the usual personal finance bromides. Spend less than you earn. Save all you can for retirement. Stick to a budget. Sure — all those are important. But after six years of dispensing financial advice or at least being in the room when we gave that advice, it really comes down to one thing: choices. And there’s almost nothing more personal in our lives than the choices we make.

Follow fads at your own risk.

Warren Buffett, the world’s most famous investor, has been criticized over the years for avoiding tech stocks and the profits they reap. His reason? He doesn’t understand them, so he sticks to the basics he knows – t-shirts, bricks, chocolate, and toilet paper among them. His philosophy seemed questionable amidst the dot-com boom of the 1990’s, but wise amidst the bubble’s pop soon thereafter. When you avoid a financial fad, you’re limiting both risk and potential reward. Only time will tell which was wisest. In the meantime, stick with what you understand.

Compound interest is key (and never ceases to amaze).

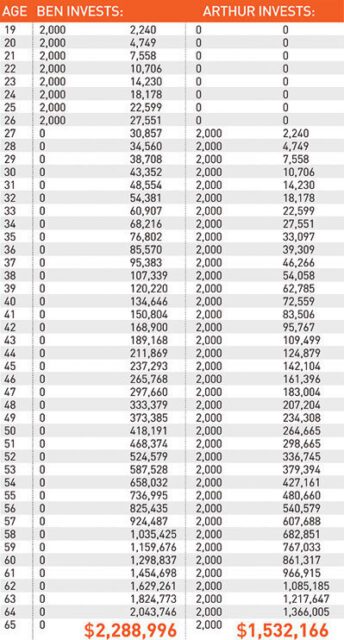

It’s one of the oldest, surest, and most frequently ignored pieces of financial wisdom. It’s the power of compound interest, and it’s the financial equivalent of a superpower for the young. Invest early at a steady interest rate, and you’ll do far better than any “grown up” working to catch up at an older age. Need a reminder? This chart from Dave Ramsey reveals the power of compound interest through a few $2000 investments at an early age as compared to many, many more by an adult:

Ready to join us on our quest to get back to basics? Check out our page devoted to Financial Basics.