Times like these can act as a wakeup call in so many ways. High on the list: the importance of saving. It’s easy to look in the rearview mirror right now, wishing we’d saved more in seasons of plenty. But there’s a more productive way to think about the topic when saving isn’t possible in the moment: make a plan for saving in the years to come. And if you’re lucky enough to be a teenager, we have good news: you hold all of the cards. Here’s why.

Table of Content

Time is on your side.

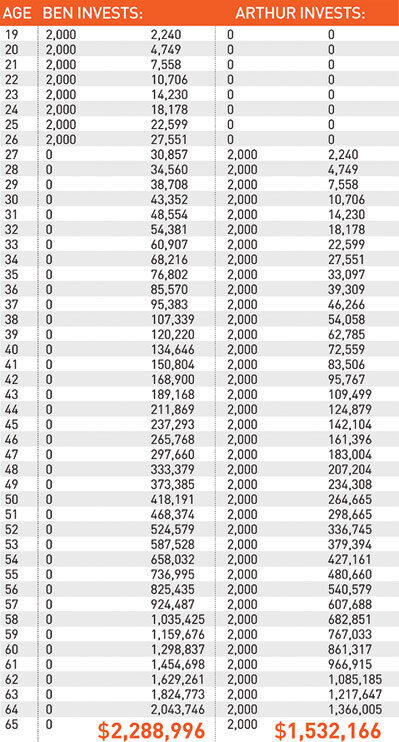

The #1 superpower of youth is just that: youth! In saving and investing, time is essential. Interest compounds like a snowball, even earning interest on interest over time. The longer you let, say, a $100 deposit sit in an interest-bearing account or investment, the more interest it will collect. Just how much more? Take a look at two deposits of the same amount, for different spans of time. In the first example, Ben invests $2000 per year from age 19 to 26. In the second, Arthur invests $2000 per year from age 27 to 65. Compound interest works its magic, giving BEN the upper hand in retirement. Incredible, isn’t it?!

Curious what a savings habit could amount to? The SEC has a free compound interest calculator on their website ready to calculate your future riches.

Expenses are low.

Youth comes with many benefits. Unless your income is needed to support your family, chances are, your expenses are pretty low. It’s not that gas, movie tickets, and eating out are cheap. It’s that they’re wants. You don’t need much of what most teens spend their wages on. As a result, you have the power to save more than the adults tasked with paying for housing, utilities, and groceries.

Risk is relative.

When you have decades ahead of you before retirement, there’s plenty of time for a mistake to get worked out, and it’s unlikely that anything you lose is essential. Those who suffered most from the 2008 recession were those who had to withdraw their investments when times were tough. The vast majority of those who stayed in recovered from their losses and have profited nicely in the years since. Don’t need those dollars this year? Just stick with your plan. Time will likely work it out.

Warren Buffett isn’t afraid.

According to The Motley Fool Reviews, famed billionaire investor Warren Buffett has a famous line that goes like this: “Be fearful when others are greedy and greedy when others are fearful.” The wisdom behind the catchy line is that it’s easy for investing to look appealing when the entire investing world has done quite well. Translation: the market is high! It can look foolish to invest when your friends are complaining about their lost funds. Translation: the market is low! But such is the counter-intuitive nature of the stock market. Buy low, sell high. To buy low, sometimes that means getting in when everyone else is getting out. Global pandemics aren’t something everyone experiences in their lifetime. We’re living in fearful times. If you’re a teen with few expenses and decades to go until you need funds for retirement, it might be the perfect time to get serious about saving.

Ready to start saving? We’ll give you the tools.

At Biz Kid$, we’ve created dozens of clips, lesson plans, and activities on the topic of saving and investing. Here are a few of our favorites: